ASML: The Backbone of the Semiconductor Industry

ASML: The Backbone of the Semiconductor Industry

The world runs on semiconductors, and at the heart of this critical industry is ASML Holding (ASML), a company that plays a pivotal role in chip manufacturing. Unlike companies that design or fabricate chips, ASML has carved out an essential niche as the sole provider of extreme ultraviolet (EUV) lithography machines, a technology required for producing the most advanced semiconductor chips. In this deep dive, I’ll break down ASML’s innovation, financial strength, and the company’s future outlook with key metrics and charts to illustrate why ASML is a must-watch tech powerhouse.

ASML’s Innovation: The Technology That Powers the Future

ASML is not just another semiconductor company—it is the only company in the world capable of producing EUV lithography machines, which are required to manufacture the latest high-performance chips used in AI, data centers, and smartphones. Here’s why ASML’s innovation is so critical:

1. EUV Lithography: The Industry Standard

EUV (Extreme Ultraviolet) lithography is a complex chipmaking process that enables manufacturers to create circuits smaller than 7 nanometers (nm).

This technology is used by companies like TSMC, Samsung, and Intel to produce the most cutting-edge chips.

In 2024, ASML recognized revenue on two High Numerical Aperture (High NA) EUV systems and shipped a third, marking significant progress in next-generation lithography technology.

2. Monopoly-Like Market Position

ASML dominates the lithography space with 100% market share in EUV technology.

Its only real competition comes from Deep Ultraviolet (DUV) machines, where Nikon and Canon compete, but ASML still holds over 60% of the market in this segment.

The increasing demand for high-performance computing ensures a steady pipeline of orders for ASML’s machines.

3. High Barrier to Entry

ASML’s EUV machines are some of the most complex pieces of equipment ever built.

The company has spent over $9 billion in R&D over the last decade to develop EUV technology.

Competitors would require years of research and billions in investment just to come close.

ASML’s Financial Strength: Metrics That Matter

ASML has been one of the most consistent performers in the semiconductor industry, delivering strong revenue growth and profitability. Below are key financial insights that highlight why ASML is a financial juggernaut.

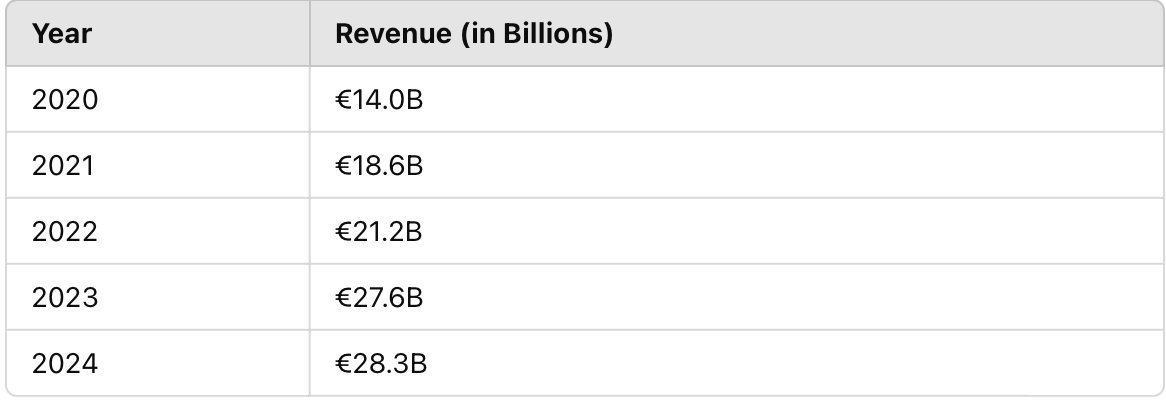

1. Revenue Growth

ASML’s revenue has continued its upward trajectory, reaching €28.3 billion in 2024, a new record.

The demand for EUV machines is driving revenue growth as more foundries upgrade to cutting-edge chip production.

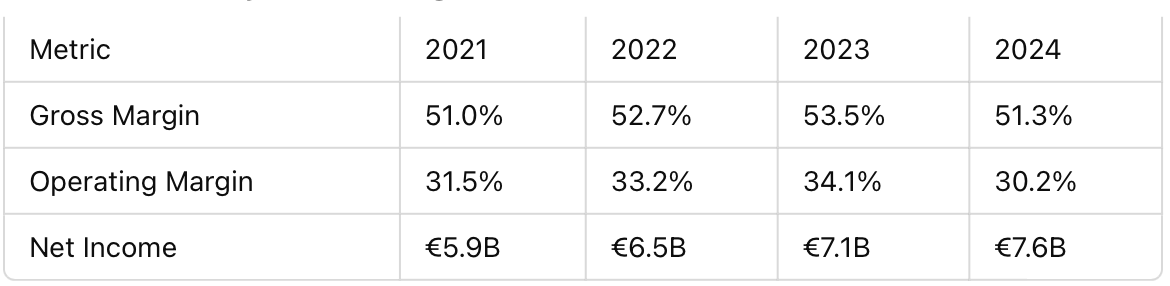

2. Profitability and Margins

ASML’s gross margin remained strong at 51.3%, reflecting pricing power and efficiency.

Net income hit €7.6 billion in 2024, driven by strong demand and cost management.

3. Order Backlog & Demand Stability

ASML's Q4 2024 net bookings reached €7.1 billion, significantly exceeding analyst expectations.

€3.0 billion of these bookings were for EUV systems, reinforcing its role in advanced chip manufacturing.

The semiconductor industry's continued expansion ensures ASML’s revenue visibility for the coming years.

ASML’s Future Outlook: Growth Opportunities Ahead

Despite already being a dominant force, ASML still has massive growth potential. Here’s why:

1. AI and High-Performance Computing Boom

The demand for AI chips (from companies like Nvidia) requires cutting-edge fabrication processes that rely on ASML’s EUV technology.

Data centers and cloud computing growth will drive the need for more advanced semiconductors, benefiting ASML’s sales.

2. Next-Generation Lithography: High-NA EUV Machines

ASML is working on High-NA (Numerical Aperture) EUV technology, which will enable the next wave of semiconductors at 2nm and beyond.

High-NA EUV machines are projected to be 50% more expensive than standard EUV machines, leading to increased revenue per unit.

3. Global Expansion and Market Penetration

ASML is expanding its supply chain and manufacturing capabilities to meet growing demand.

The CHIPS Act in the U.S. and semiconductor investment in Europe are providing incentives for foundries to increase production, driving more sales for ASML.

The company expects Q1 2025 net sales between €7.75 billion and €8.0 billion, with a projected gross margin between 52% and 53%.

Why ASML is a Must-Watch Investment

ASML is a one-of-a-kind company with no direct competition in its most valuable market. The combination of its technological leadership, financial strength, and monopoly-like position in EUV lithography makes it one of the most compelling investment opportunities in the semiconductor space.

Key Takeaways:

✔️ ASML is the only company in the world that makes EUV lithography machines, which are required for cutting-edge semiconductor production. ✔️ Strong financials with high margins, growing revenues, and a massive order backlog. ✔️ Critical player in AI, cloud computing, and advanced chip manufacturing. ✔️ Next-gen High-NA EUV technology will further extend ASML’s leadership. ✔️ Semiconductor industry growth and government support ensure long-term demand.

For anyone looking at the future of technology and computing, ASML is not just an important company—it’s the foundation upon which the next era of semiconductor advancements will be built. If you’re serious about investing in cutting-edge tech, ASML is a company that should be on your radar.